Expertise and tools for smarter loan reviews and credit intelligence.

Benefit from credit insights, streamlined loan reviews and huge time savings — with these loan review services and cloud-based solutions designed by credit experts.

What is Your Loan Data Telling You (and Regulators)?

Featured Speaker

Zane Smith, EVP, Chief Credit Officer & Chief Risk Officer

Our Satisfied Customers

IntelliCredit’s Loan Review Service Delivers Huge Time Savings.

IntelliCredit: Game-changing Loan Review Services Plus Solutions for

Your Internal Team

-

Smart Loan Review™ Service

Loan Review Services performed by credit experts

IntelliCredit delivers game-changing loan reviews that combine Deep Credit Expertise and an Online, Real-time Portal. Your bank benefits from huge time savings, process transparency, plus fewer meetings and intrusions. -

Smart Loan Review™

Cloud-Based Application for your internal loan review

Revolutionary solution that helps internal teams automate and expedite the loan reviews they perform, making the process simple, organized, retrievable, and fast. -

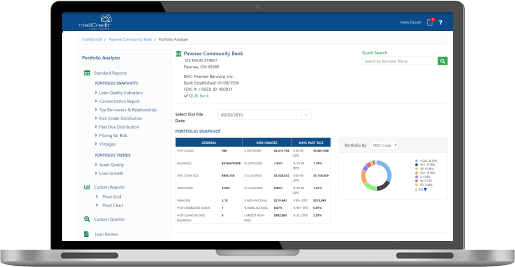

Portfolio Analyzer

Cloud-Based Application for credit intelligence

Delivers insightful analysis of your portfolio and loan data so you can identify hotspots, detect risk earlier, and write your own credit script – before the regulators do it for you.

IntelliCredit:Built by Credit Specialists

Unlike so many risk-focused fintech tools, IntelliCredit was created by true credit specialists whose decades of expertise in managing and analyzing credit risk inform every data point, chart, calculation and process.

Rely on the service quality that only QwickRate and IntelliCredit provide.

- 30+ years focused on serving community banks

- Credit risk specialists to help inform your decisions

- Great customer support from dedicated experts eager to help